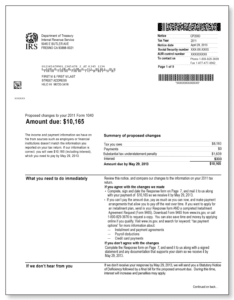

CP2000: This letter informs you that the IRS has found a discrepancy in your tax information. This may increase or decrease your taxes. It may, in some cases, leave it the same. Either way it is important to review the infromation contained within the letter. Whether you agree with the IRS assesment or not, you need to fill out the notice response form. This is usually due to the IRS receiving information from an employer that contradicts what you filed. If the information the IRS has is wrong, it is important you obtain the correct information from said employer and mail the IRS a copy along with the response form.

Clean Slate Tax LLC is a Better Business Bureau Accredited tax firm that helps individuals and businesses with a variety of IRS and State tax problems. We help taxpayers get back into compliance with IRS & State tax laws at an affordable price. Most importantly, all services are done by licensed tax professionals (Attorney, EA or CPA)