Nobody’s perfect. We all make mistakes and we all mess up. When it comes to taxes, messing up can be a real pain to deal with. Of course, getting your taxes filled out and filed correctly the first time is always best, but again, nobody’s perfect. The good news is even if you do mess up the first time all hope is not lost. That’s because the IRS allows you a do-over by letting you file an amended return. To be clear, you do not have to file an amended return for every little mistake made on a tax return, but if your errors are bad enough then it’s better to be safe than sorry and send in a do-over. However, before you fill out an amended return and ship it off to the IRS, make sure you know what you’re doing. You don’t want to mess up twice.

Nobody’s perfect. We all make mistakes and we all mess up. When it comes to taxes, messing up can be a real pain to deal with. Of course, getting your taxes filled out and filed correctly the first time is always best, but again, nobody’s perfect. The good news is even if you do mess up the first time all hope is not lost. That’s because the IRS allows you a do-over by letting you file an amended return. To be clear, you do not have to file an amended return for every little mistake made on a tax return, but if your errors are bad enough then it’s better to be safe than sorry and send in a do-over. However, before you fill out an amended return and ship it off to the IRS, make sure you know what you’re doing. You don’t want to mess up twice.

Know Before You Go

So what do you need to know when you file an amended return? First, when you choose to amend your return you can’t choose which items to fix. In other words, if you find more than one mistake you have to fix them all, and not just the ones that will benefit you. Make sure you correct them all or you could wind up getting the IRS’s attention. Meantime, as mentioned previously, not all errors warrant filing an amended return. For example, if you make simple math errors, the IRS will typically correct those for you. Likewise, if you forget to attach a form don’t file an amended return, instead just wait to see if the IRS requests that form.

Timing Matters for Amended Returns

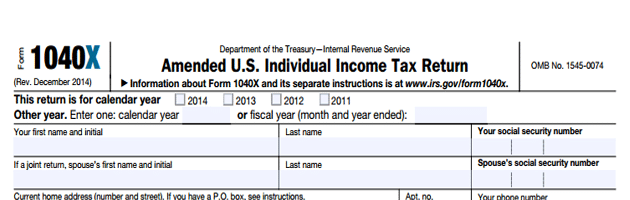

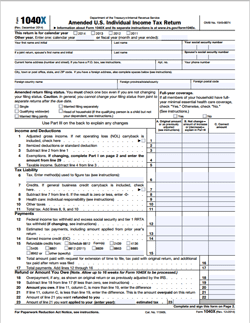

When it comes to filing an amended return, timing matters. You must file an amended return within three years of when you filed your original return, or within two years from the time you actually paid the tax, whichever date is later. Also, even though the IRS prefers e-file for first-time returns, when it comes to amended returns you can only file them on paper, using Form 1040X Amended U.S. Individual Tax Return. That even includes those who originally filed their return vie e-file. So what should you do if you have discovered errors on multiple returns? You need to actually file amended returns separately for each year you file. You can’t correct more than one year on each Form 1040X.

Does Amendment Equal Audit?

While it is not a set rule, when you file an amended return it is more likely to catch the IRS’s eye and be selected for an audit. One thing that will really get the IRS’s attention is if you file an amended return that consists of a large refund. Even if your amendment is correct, it could still trigger an audit. One way to avoid this is to simply apply your refund to the current year’s taxes, as an estimated tax payment. Another good thing about amended returns is that the IRS doesn’t get extended time to audit them. They still only have three years from the original filing date to perform an audit. Lastly, keep in mind that you might owe interest and penalties on your amended return, which you should plan on paying at the time you file your amended return. So remember, if you mess up on your tax return, it’s not the end of the world. Just make sure you get it right the second time.