On March 28th, 2016, the IRS made adjustments to their financial expense tables or Collection Financial Standards to make it more difficult for taxpayers with tax liabilities to qualify for tax relief. Allowable expenses are limits the IRS allow taxpayer’s to claim when qualifying them for tax relief programs. Collection Financial Standards set by the IRS help determine how much “cash flow” a delinquent taxpayer has on a monthly basis to meet not only household living expenses, but also “reasonable and necessary” expenses. The IRS adjusted downwards what they consider “allowable living expenses” by as much as 10% recently.

Out-Of-Pocket Health Care Standard Falls Almost 10% Even as Healthcare Costs Rise

The IRS also sets Out-Of-Pocket Health Care standards, or allowances for out of pocket health care costs like prescription drugs, glasses, contact-lenses and so forth. For example, the IRS had previously automatically allowed every household member under 65, $60 per month for out of pocket health care, such as for co-pays or prescription medicine. The IRS has now adjusted this figure downwards by 10% to $54 even as the cost of healthcare continues to skyrocket.

| 3/30/2015 | 3/28/2016 | % Change | |

|---|---|---|---|

| Under 65 | 60 | 54 | -10.00% |

| 65 and Older | 144 | 130 | -9.72% |

| Average | 102 | 92 | -9.86% |

Take the following example:

A family of 5, after accounting for all expenses, qualified for a partial pay installment agreement of $25 after claiming $300 in out of pocket health care expenses. With the new revisions allowing only $270, the same family will no longer qualify for a $25 plan but will have to make payments of $55 per month instead, an increase of over 100%!

IRS Changes Hit Bigger Families Harder

The IRS sets “National Standards” for five necessary expenses: food, housekeeping supplies, apparel and services, personal care products and services, and miscellaneous. In other words, no matter where a taxpayer lives in the country, these standards are consistent and only vary based on the number of individuals in a household. The “National Standard” changes are illustrated below, with the biggest percentage changes highlighted in yellow. As you can see from figure 1 below, the biggest change impacted families of 5 or more, as the amount the IRS allows for necessary living expenses dropped by almost 10% for each additional individual in a family of five or more.

| Expense | 1 Person (3/30/2015) | 1 Person (3/28/2016) | % Change | 2 Persons (3/30/2015) | 2 Persons (3/28/2016) | % Change | 3 Persons (3/30/2015) | 3 persons (3/28/2016) | % Change | 4 persons (3/28/2015) | 4 persons (3/28/2016) | % Change | Total allowance Each Additional Over 4 (3/30/2015) | Total Allowance Each Additional Over 4 (3/28/16) | % Change |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Food | $315 | $307 | -2.54% | $588 | $583 | -0.85% | $660 | $668 | 1.20% | $821 | $815 | -0.73% | |||

| Housekeeping supplies | $32 | $30 | -6.25% | $66 | $60 | -9.09% | $65 | $60 | -7.69% | $78 | $71 | -8.97% | |||

| Apparel & services | $88 | $80 | -9.09% | $162 | $148 | -8.64% | $209 | $193 | -7.66% | $244 | $227 | -6.97% | |||

| Personal care products & services | $34 | $34 | 0.00% | $61 | $61 | 0.00% | $64 | $62 | -3.13% | $70 | $74 | 5.41% | |||

| Miscellaneous | $116 | $119 | 2.52% | $215 | $231 | 6.93% | $251 | $266 | 5.64% | $300 | $322 | 6.83% | |||

| Total | $585 | $570 | -2.56% | $1,092 | $1,083 | -0.82% | $1,249 | $1,249 | 0.00% | $1,513 | $1,509 | -0.26% | $378 | $341 | -9.79% |

Transportation Standards Dropped Almost 10%

The IRS also sets standards for transportation. This is broken up into public transportation, and private transportation. There are national figures for monthly loan or lease payments (ownership costs) as well as operating costs, which are determined by the region the taxpayer lives in the country. We averaged the operating cost changes by region, and the IRS dropped those operating costs by close to 10%. However, many would argue that this change is warranted since gas prices have fallen dramatically. However, this does not explain the changes in the ownership standards.

| 3/30/2015 | 3/28/2016 | % Change | |

|---|---|---|---|

| Public Transportation | $185 | $173 | -6.49% |

| Ownership Costs One Car | $517 | $471 | -8.90% |

| Ownership Costs Two Cars | $1,034 | $942 | -8.90% |

| Operating Costs | 3/30/2015 | 3/28/2016 | |

| Average | 381 | 344 | -9.83% |

Housing and Utilities Standard Changes Were Small but Not for All Counties

The IRS also has local housing and utilities standards that are derived from the U.S. Census Bureau, American Community Survey and BLS Data, and are set at the county level. Although the average change from 2015 to 2016 resulted in only a -1.9% decrease overall (when averaging standards changes across all counties and household sizes), not all counties fared the same.

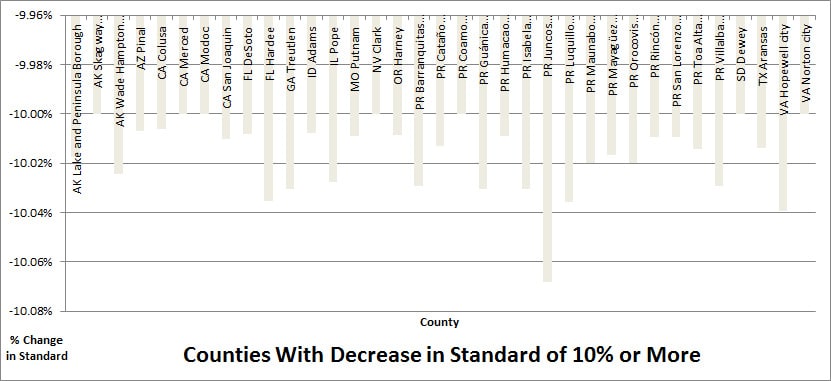

By analyzing the data, we noticed there were a few counties that had decreased by 10% or more. The following graph of households for a family of 1 below summarizes the outliers:

As illustrated by the data, many counties in Puerto Rico, California, Alaska, Virginia, and Texas were adjusted downwards.

With these changes, the IRS has made it more difficult than at any point in the last few years to qualify for their tax relief programs. It is more important than ever that you have a qualified professional assist you with resolving your tax problems as the margin for error has decreased significantly.