The IRS recently released enforcement data for 2013 regarding collections, penalties, and criminal investigations. Of particular interest was the data pertaining to IRS tax liens and IRS tax levies. Tax liens and tax levies are enforcement mechanisms the IRS uses in order to secure the repayment of taxes owed whether it be from a business or an individual taxpayer.

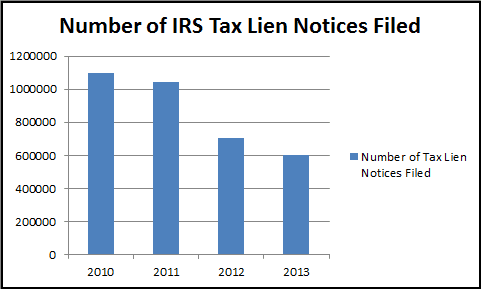

For 2013, the number of notices of Federal tax liens field or the number of lien requests entered in the IRS Automated Lien System dropped by 105,763 when compared to 2012. This represents a 14.94% decrease in Federal tax liens filed by the IRS from 2012 to 2013. The trend in tax lien notices being field has been sharply downward over the four years as illustrated in the bar graph below (figure 1). Even more interesting is that figure 1 represents a 45.09% decrease in tax liens filed from 2010 numbers.

Figure 1 – IRS Tax Liens Notices Filed 2010-2013

Unlike a Federal tax lien, which is the government’s claim against a taxpayer’s property for back taxes, a Federal tax levy is the actual legal seizure of property for unpaid taxes (without a judgement). In general, this includes, but is not limited to, bank levies (seizing part or all of a taxpayer’s bank account), levies on investment accounts, or seizing part of a taxpayer’s wages to satisfy unpaid taxes (a form of administrative levy).

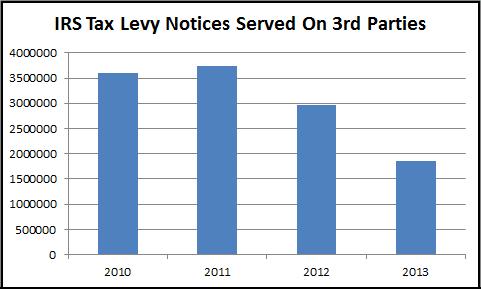

The trend in tax lien notices over the last few years, is similar to the downward trend seen with IRS tax levy notices served on third parties by the Automated Collection system and Field Collection programs. The number of tax levy notices filed in 2013 fell by a little more than 1 million or 1,106,067. This represents a 37.35% decrease in IRS tax levy notices served from 2012 to 2013. More interesting is the overall trend over the last four years. Even with the little spike in IRS levy notices served from 2010 to 2011, the overall trend is down over the last four years as seen in figure 2 below.

Figure 2 – IRS Tax Levy Notices Served on 3rd Parties 2010-2013

The overall downward trend we see in IRS tax levies and liens can be due to a number of factors including the IRS Fresh Start Initiave, the possibility that more taxpayers are staying in tax compliance and/or the effects of a strengthening economy. There is no doubt that a part of this downward trend is due to the implementation of the IRS’s Fresh Start Program—the program that is helping taxpayers get back on their feet by easing up on lien and levy filing thresholds.