When people get married they typically exchange vows. Many married couples love and support each other throughout their marriages even when times get tough. For most couples when something goes bad for one spouse, the other spouse is affected just the same. So what about credit scores? Can a marriage be affected by bad credit? Money is often listed as one of the top reasons couples end up getting divorced. However, what if only one spouse has financial problems; can it still affect the other? Yes, it can. What if the IRS issues a lien on one spouse; will it bring the other spouse’s credit down too?

When people get married they typically exchange vows. Many married couples love and support each other throughout their marriages even when times get tough. For most couples when something goes bad for one spouse, the other spouse is affected just the same. So what about credit scores? Can a marriage be affected by bad credit? Money is often listed as one of the top reasons couples end up getting divorced. However, what if only one spouse has financial problems; can it still affect the other? Yes, it can. What if the IRS issues a lien on one spouse; will it bring the other spouse’s credit down too?

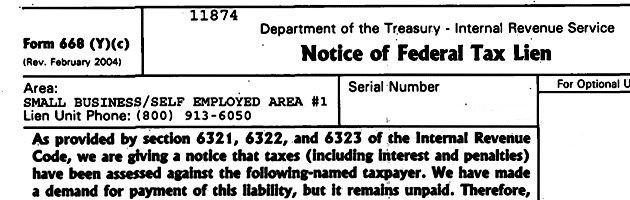

What Is a Tax Lien?

So what is a tax lien and when does the government issue them? If you can’t pay your bill and you don’t take the time to set up a payment plan with the IRS then the taxman can put a lien on your assets. Essentially, it’s is the government’s claim on your property, including your bank account, your car, your home and even your business accounts. When the government issues a lien on your assets it is basically getting ready for the next step in the process, which is a tax levy. When you face a tax levy that means the IRS can start collecting its money from you by using force, such as garnishing your wages.

Negative Effects of a Tax Lien

While it’s not as bad as a tax levy, a tax lien definitely has negative consequences, especially on your credit. Being able to borrow money becomes a lot more difficult as lenders are much more hesitant to loan money to those who have been issued a lien. If you try to apply for a business loan, a car loan or even for a new credit card, it might be difficult to receive any type of financing with a tax lien. But what about your spouse; can a tax lien on you affect your spouse’s credit, too? The answer depends on how you look at things. If you file taxes jointly, then you will both be affected. However, if you file separately, a tax lien on one spouse can still affect the other spouse, as well. While your lien won’t directly show up on your spouse’s credit report, it can still hurt him or her indirectly.

If it Hurts You Then it Probably Hurts Your Spouse too

As mentioned earlier, if you try to borrow money with a tax lien on your credit, it’s likely that you will have a tough time getting financing because a lien will hurt your credit score. Because many couples apply for credit together, for things such as vehicles or a home, a lien on one spouse can negatively affect the other in this situation. In addition, some states’ laws allow the government to place a lien on property jointly owned. Those states include California, Texas, Idaho, Arizona, Washington, Nevada, Wisconsin, New Mexico and Louisiana. These are community property states, so the government usually considers all debts and assets in a marriage to be held jointly, which means both spouse’s could be affected by a tax lien on just one of them.

For Richer, for Poorer, for Good Credit, for bad Credit

The best way to avoid a tax lien if you are having trouble paying your tax bill is to simply contact the IRS and set up a payment plan, which the IRS will typically accept, unless you owe a very large sum of money or your case involves unusual circumstances. In any case, while “bad credit” or “tax lien” may not show up in your wedding vows, if the IRS does issue an individual tax lien on you, then chances are your spouse is going to feel the negative effects just the same as you.