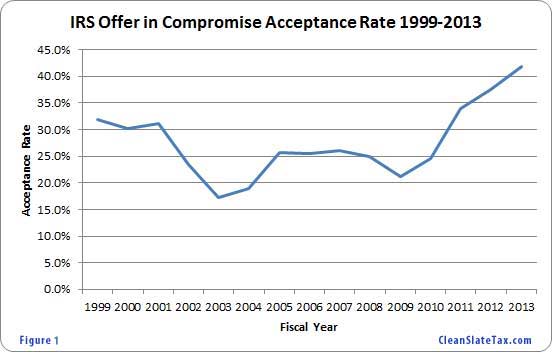

The IRS released recently data that showed that the offer in compromise (oic) acceptance rate reached 41.8% last year. This represents an 11.70% increase in the acceptance rate from 2012 and a 94.83% increase in the Federal oic acceptance rate from 2009. Most importantly, an acceptance rate of 41.8% for 2013 represents an all time high, or at least since 1999 when the IRS began reporting offer in compromise acceptance rates in their annual data books. Below is a table representing offer in compromise acceptance rates since 1999 (see figure 1 below).

IRS offer in compromise acceptance rates 1999-2013

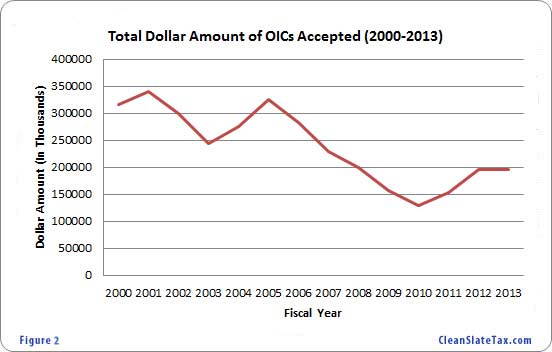

Total Dollar Amount of OICs is Not at a High, Despite High Acceptance Rate

Even with a an all-time Federal offer in compromise acceptance rate, the cumulative dollar amount for OICs accepted is not at a high. In other words, the dollar amount per offer in compromise is not at a high when looking at the last 13 years (see figure 2 below). In fact from 2012, the total dollar amount for OICs accepted decreased (but only by .13%). The IRS began posting the total dollar amount of OICs accepted in 2000.

What is an Offer in Compromise?

An offer in compromise, often referred to as an “OIC” or “offer,” is a type of tax settlement or IRS resolution whereby a taxpayer can settle their tax debt for less than owed. From a high level, it is based off a taxpayer’s (business or individual) ability to pay, equity in assets, income and expenses. The IRS will accept an offer if they feel that the offer amount is equal to or more than they could collect over a reasonable period of time.

IRS Fresh Start Changes Causing OIC Acceptance Rate to Increase?

It is definitely a major factor for sure. With the “Fresh Start” initiative that started in 2008, the IRS eased up on taxpayers in many ways by creating more flexible resolution options. In January of this year alone, the IRS made it easier for certain taxpayers to get an offer in compromise accepted by changing how they calculate a taxpayer’s future income. Moreover, the IRS now allows for the repayment of student loans, state and local delinquent taxes, and has expanded the Allowable Living Expense category and amount.

Other changes that are influencing the offer in compromise acceptance rate have to do with how the IRS calculates a taxpayer’s reasonable collection potential. For example, the IRS considers only one year of future income for OICs paid in five months or less (formerly four years), and two years of future income for OICs paid in 6-24 months (formerly five years).

Source: IRS Data Book (various years)